Communication Service Providers (CSPs) face an upcoming mountain of calls when it comes to tax scams. in protecting their telecommunications networks from spam, fraud, and unlawful activity. In fact, fighting robocalls and these issues is a federal priority in both the USA and Canada. Two key tools that CSPs use to protect their networks are behavior monitoring and phone number scoring.

In this article, we cover:

- Tax Scam Calls and CSP risks and costs

- 7 Ways to Minimize Tax Scam Calls (and other phone fraud)

- Benefits of Outsourced Robocall Mitigation Support Service

Tax Scam Calls And Service Provider Risks And Costs

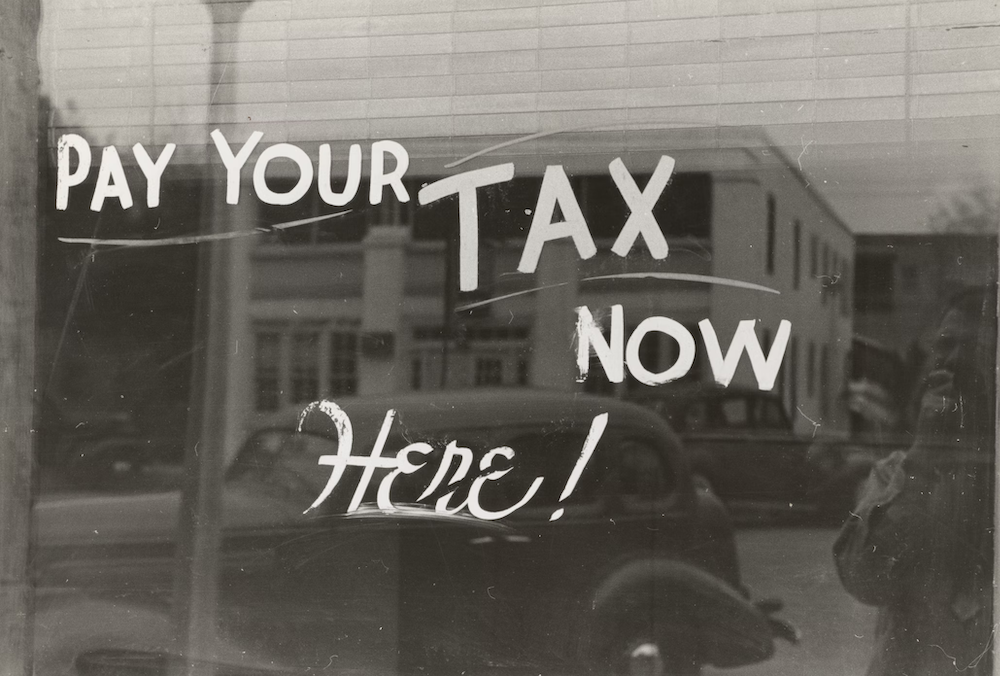

Every tax season, calls ramp from about 5 million calls per month in the USA, up to a peak of 100 million tax scam calls per month or more. There are a wide range of problems that Communication Service Providers and their vendors face when it comes to tax scams.

The first problem is regulatory compliance. The FCC takes the topic very seriously, with several pages on their website for consumers about tax scam calls. The FCC has pushed compliance and stopping those calls down to the CSP, and is taking strong action against lax CSPs, sending even more cease & desist letters to providers who are not doing enough to stop robocalls.

Another significant issue is the customer impact. When CSPs are not effectively blocking these calls, they are likely to face increased customer complaints and decreased satisfaction.

There also could be legal issues, a small call volume impact, and related network technical or IT challenges.

7 ways To Minimize Tax Scam Calls (And Other Phone Fraud)

Here are 7 ways that Communication Service Providers (CSPs) can address the challenges of tax scam calls on their networks:

- Implement STIR/SHAKEN: As most CSPs already know, STIR/SHAKEN is a set of technical standards that help to verify the authenticity of caller ID information and prevent caller ID spoofing. CSPs can implement STIR/SHAKEN to help combat tax scam calls, as many of them are spoofing the IRS numbers.

- Offer Call-Blocking and Labeling Features: CSPs can provide customers with call-blocking and labeling features that allow them to block or label unwanted calls, including tax scam calls.

- Use Advanced Analytics and Machine Learning: CSPs can leverage advanced analytics and machine learning techniques to identify and block tax scam calls in real-time, even when the calls are using spoofed caller IDs.

- Work with Law Enforcement: CSPs can work with local and international law enforcement agencies to investigate and prosecute tax scammers. This can help to reduce the number of tax scam calls and make it more difficult for scammers to operate. (Sometimes the partner organizations, such as YouMailPS, will also help CSPs work with law enforcement.)

- Educate Customers: CSPs can educate customers about the dangers of tax scam calls and how to identify and protect themselves from these types of scams.

- Collaborate with Peers: CSPs can collaborate with other CSPs and industry groups to share information and best practices for combatting tax scam calls.

- Enhance Network Security: CSPs can enhance the security of their networks to prevent unauthorized access and reduce the opportunities for scammers to find other ways to perpetrate tax scam calls.

There are a number of straightforward ways that Communication Service Providers can reduce the number of tax scam calls on their networks this upcoming tax season. But they each take some IT efforts, and potentially a capital investment that not all CSPs are willing to invest. In addition, there are some elements of scam call reduction that only the largest CSPs may be able to execute in-house.

Benefits Of Outsourced Robocall Mitigation Support Services

Some of the methods to reduce tax scam calls by CSPs clearly must be handled in-house. However, there are certain elements of an outside robocall mitigation support team that provide extensive benefits.

Consider organizations such as YouMailPS, which is related to its consumer brand, YouMail. The YouMail network offers consumers a variety of free services. Those free services then provide billions of data points that a typical CSP would not have access to, including audio analytics of spam calls. These data points, combined with many years of development (including sophisticated AI/ML algorithms), allow external partners to successfully identify a much higher percentage of fraudulent callers, to track them beyond phone numbers by their activity “fingerprints,” and to do so at a lower cost than for the CSP to do it themselves.

In addition, outside providers are often more familiar with the legal requirements, reducing both your risk from the FCC as well as from lawsuits.

Finally, often the cost of outsourcing is lower than the cost of developing and maintaining an internal IT team to do the work yourself.

YouMail Protective Services helps CSPs minimize tax scam calls, fighting fraud on their networks. Get a free whitepaper on The Critical Role of Audio Analytics in Robocall Threat Mitigation Programs here >